These SMSF portfolio ideas contain portfolio balancing methods that are commonly used. People choose different methods based on a variety of reasons including their age compared to the expected retirement dates, future plans, income needs and can even factor in economic sentiment.

While these ideas are more structured towards the risk and asset types, our other articles cover interesting stocks to watch, and our stock screener tool for ASX and other markets can help refine your stock selection method and even us the AI report reading tool to go deep on each financial report released by the company of your choice. We also offer a similar service for US stocks too.

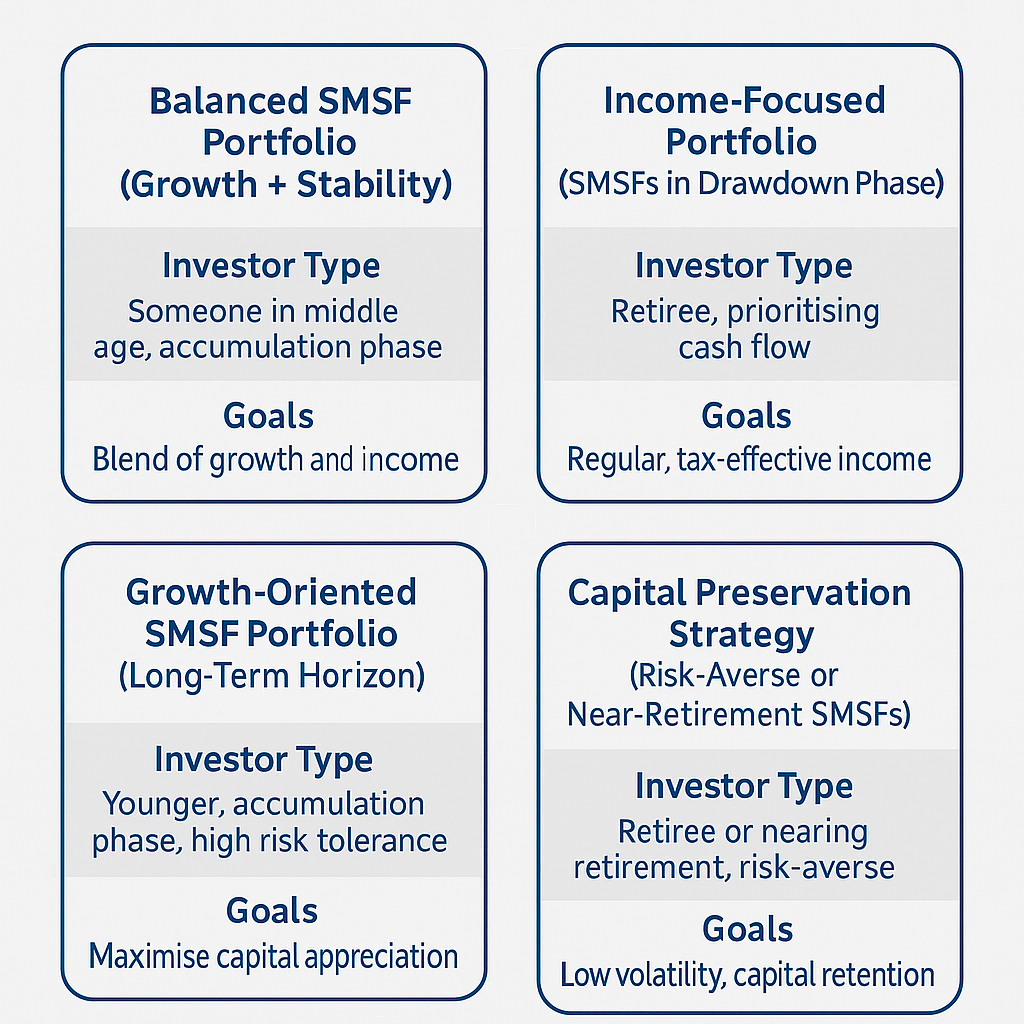

1. Balanced SMSF Portfolio (Growth + Stability)

Designed to spread risk across multiple asset types:

- 40% Australian Shares – blend of dividend payers and large-cap blue chips

- 20% International Shares – US, global ETFs or managed funds

- 20% Fixed Income – government bonds, corporate bond ETFs

- 10% Property (REITs or direct)

- 10% Cash & Term Deposits – for liquidity and risk offset

This type of approach balances income with capital growth potential.

Common Investor Profile in SMSF Portfolios

Generally suited for middle-aged trustees (40s–60s) who are still in the accumulation phase but want to avoid excessive volatility. They value a blend of growth and income.

Why They Use It

These investors don’t want to take on the full risk of a growth-only portfolio but also don’t want to be too conservative. They prefer diversification across shares, bonds, property, and cash, giving them resilience in downturns without sacrificing upside potential.

Common SMSF Portfolio Scenario

Couples or individuals who plan to retire in 10–20 years and want steady, compounding growth while protecting capital from sharp drawdowns.

2. Income-Focused Portfolio (SMSFs in Drawdown Phase)

Often chosen by trustees prioritising cash flow:

- 50% Australian Dividend Stocks – banks, infrastructure, utilities

- 20% Listed Property Trusts (REITs) – commercial/industrial focus

- 20% Fixed Income / Hybrids – corporate bonds, income ETFs

- 10% Cash Buffer

Popular with SMSFs seeking consistent distributions or tax-effective income via franking credits.

Common Investor Profile in SMSF Portfolios

Suited for retirees or near-retirees who have transitioned their SMSF into the pension phase and require reliable, tax-effective income streams.

Why They Use It

They prioritise cash flow and consistency, not capital growth. High dividend shares (with franking credits), REITs, and bond income provide predictable distributions to fund living expenses.

Common SMSF Portfolio Scenario

A trustee drawing a pension from their SMSF, relying on dividends and distributions as their main income, while keeping some cash on hand for liquidity.

3. Growth-Oriented SMSF Portfolio (Long-Term Horizon)

Designed for trustees in accumulation phase:

- 60% Shares – diversified between Australian and global markets

- 25% Alternatives – thematic ETFs, small caps, private equity exposure

- 10% Property / Infrastructure – via REITs or funds

- 5% Cash / Short-term Instruments

Aimed at capital growth and higher-risk tolerance, often with longer timeframes in mind.

Common Investor Profile in SMSF Portfolios

Best for younger trustees (30s–50s) in the accumulation phase with high risk tolerance and a long time horizon until retirement.

Why They Use It

They want to maximise capital appreciation and can withstand short-term volatility. Exposure to global equities, thematic ETFs, small caps, and alternatives is favoured over income-generating assets.

Common SMSF Portfolio Scenario

Professionals or business owners using their SMSF as a long-term wealth builder, reinvesting dividends and riding out market cycles with the aim of significantly increasing retirement savings.

4. Capital Preservation Strategy (Risk-Averse or Near-Retirement SMSFs)

Focused on lower volatility and capital retention:

- 30% Income Shares / Dividend Stocks

- 40% Bonds / Fixed Income – ETFs, term deposits, annuities

- 20% Cash / Liquid Assets

- 10% Gold or Defensive ETFs

Used when the priority is downside protection and income stability.

Common Investor Profile in SMSF Portfolios

Appeals to trustees in or close to retirement who are risk-averse and want to safeguard accumulated wealth. Also common for those with larger balances who prefer not to jeopardise their capital.

Why They Use It

Their priority is stability and low volatility, often with an emphasis on cash, bonds, and defensive assets like gold. They would rather miss out on upside than risk large losses.

Common SMSF Portfolio Scenario

Trustees in their late 60s or 70s who live off income distributions but place capital protection first, ensuring funds are available to meet pension payments and estate planning goals.

Important Considerations

When trustees build an SMSF investment strategy, they typically:

- Refer to their SMSF Investment Strategy Document

- Align investments with their risk profile, goals, and time horizon

- Regularly review and rebalance based on market conditions or personal changes

- Keep detailed records for compliance and audit requirements

Note: These are general educational examples. They are not personal or financial advice. Trustees must make their own decisions or seek advice from a licensed financial adviser.

FAQ

Q: Do SMSFs have to invest in shares or property?

A: No. SMSFs can invest in many asset types, including cash, fixed interest, property, and collectibles, as long as it complies with superannuation laws and the fund’s investment strategy.

Q: Can I invest in international markets through an SMSF?

A: Many SMSFs use ETFs, managed funds, or direct broker accounts to gain exposure to global equities or bonds.

Q: Should SMSFs always chase high returns?

A: Trustees are legally required to consider risk and diversification. Many focus on sustainability and alignment with their retirement objectives rather than maximum return.

0 Comments